- Credit 101

- Teaching Tools

- Scores

- Life Stages

- Credit Mishaps

- Understanding Different Bankruptcy Chapters

- Your Credit Report After a Bankruptcy

- Understanding Judgments

- Inaccuracies on Your Credit Report

- Disputing Credit Report Errors

- Understanding Foreclosure

- The Foreclosure Process & What To Do Afterwards

- Understanding Identity Theft

- In the event of: The Death of a Spouse

- Rebuilding Your Credit

- Choosing a Reputable Credit Counselor

- Avoid the Downside of Credit Mismanagement

- What is a Credit Freeze

- Worksheets & Letters

- 6 Steps to Creating a Budget

- Household Budget: Wants vs Needs

- Personal Budget Template

- Understanding Amortization Schedules

- Loan Amortization Calculator

- Sample Opt-Out Letter

- Sample Dispute Letter

- Annual Credit Report Request Form

- Auto Loan Payment Calculator

- Back-to-School Budgeting

- Cost of Credit

- Emergency Fund

- How Much Car Can You Afford

- How Much House Can You Afford

- How Much Will College Cost

- How Much Will My Loan Cost

- How Will My Savings Grow

- Mortgage Payment

- Mortgage Refinancing

- Pay Down Debt or Invest

- Repaying Student Loans

- Retirement Fund

- Rework Your Budget

- Saving for a Goal

- Should I Consolidate My Debt

- Travel Budgeting

- Your Holiday Budget

- Buying a House

- 5 Steps to Buying a Home

- 5 C's of credit When Applying for a Loan

- What Score is Needed to Purchase a Home

- Using a Realtor

- Understanding Fixed Rate Mortgages

- Understanding FHA Loans

- Understanding VA Loans

- Understanding Interest Only Loans

- Understanding ARM Loans

- Understanding Combo Loans

- Understanding Streamline K Loans

- Understanding Bridge Loans

- Understanding HELOC (Home Equity Line of Credit)

- Understanding Reverse Mortgages

- Basic Mortgage Underwriting Principles

- Credit & Financial Law

- Home

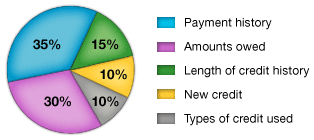

What makes up your credit score?

Payment History – 35%

Account payment information on specific types of accounts (credit cards, retail accounts, installment loans, finance company accounts, mortgage, etc.)

Presence of adverse public records (bankruptcy, judgments, suits, liens, wage attachments, etc.), collection items, and/or delinquency (past due items)

Severity of delinquency (how long past due)

Amount past due on delinquent accounts or collection items

Time since (recency of) past due items (delinquency), adverse public records (if any), or collection items (if any)

Number of past due items on file

Number of accounts paid as agreed

Amounts Owed – 30%

Amount owing on accounts

Amount owing on specific types of accounts

Lack of a specific type of balance, in some cases

Number of accounts with balances

Proportion of credit lines used (proportion of balances to total credit limits on certain types of revolving accounts)

Proportion of installment loan amounts still owing (proportion of balance to original loan amount on certain types of installment loans)

Length of Credit History – 15%

Time since accounts opened

Time since accounts opened, by specific type of account

Time since account activity

New Credit – 10%

Number of recently opened accounts, and proportion of accounts that are recently opened, by type of account

Number of recent credit inquiries

Time since recent account opening(s), by type of account

Time since credit inquiry(s)

Re-establishment of positive credit history following past payment problems

Types of Credit Used – 10%

Number of (presence, prevalence, and recent information on) various types of accounts (credit cards, retail accounts, installment loans, mortgage, consumer finance accounts, etc.)

Please note that: A score takes into consideration all these categories of information, not just one or two. No one piece of information or factor alone will determine your score. The importance of any factor depends on the overall information in your credit report.

For some people, a given factor may be more important than for someone else with a different credit history. In addition, as the information in your credit report changes, so does the importance of any factor in determining your score. Thus, it's impossible to say exactly how important any single factor is in determining your score - even the levels of importance shown here are for the general population, and will be different for different credit profiles. What's important is the mix of information which varies from person to person, and for any one person over time.